Navigating Shifting Tides: IEEPA Tariffs Face New Hurdles, US De Minimis Closes Amidst Air Capacity Realignment – September 2, 2025 Update

The global logistics landscape continues its dynamic evolution, with the latest Freightos.com weekly update for September 2, 2025, highlighting significant developments that warrant careful attention from businesses involved in international trade. The report, titled “Further challenges to IEEPA tariffs; US de minimis closed as air capacity shuffles,” paints a picture of evolving regulatory pressures and a recalibration of air freight capacity, both of which carry substantial implications for supply chain strategies.

Renewed Challenges to IEEPA Tariffs:

One of the most prominent pieces of news concerns the ongoing challenges to tariffs imposed under the International Emergency Economic Powers Act (IEEPA). While specific details of the “further challenges” are not elaborated upon in the headline, this development suggests that businesses and industry groups are actively seeking to mitigate or overturn these tariffs. IEEPA tariffs, often enacted due to national security concerns or in response to specific geopolitical events, can significantly impact the cost and flow of goods.

The persistence of these challenges indicates a continued effort to find pathways for more favorable trade conditions. Businesses that have been affected by IEEPA tariffs, or those anticipating their impact, should monitor these legal and political developments closely. Any successful challenge could lead to reduced costs, increased import flexibility, and a more predictable operating environment for affected goods. Conversely, the continued imposition or expansion of such tariffs underscores the need for robust contingency planning and the exploration of alternative sourcing or logistics strategies.

US De Minimis Threshold Closes, Impacting Small Shipments:

Another critical development is the reported closure of the US de minimis threshold. The de minimis rule allows shipments valued below a certain threshold to enter the United States without the payment of duties and taxes, simplifying the process for low-value imports. The closure of this threshold, as reported by Freightos, implies that previously exempt shipments will now be subject to standard import procedures, including duty and tax assessments.

This change is likely to have a considerable impact on e-commerce businesses, small manufacturers, and individual consumers who frequently send or receive smaller consignments to the US. The increased administrative burden and potential cost implications for these types of shipments are significant. Businesses relying on the de minimis exemption will need to reassess their pricing strategies, explore options for consolidating shipments to meet higher thresholds (if applicable), or factor in the new duty and tax costs into their landed cost calculations. This closure could also lead to a surge in demand for services that assist with navigating these new import requirements.

Air Capacity Shuffles and Their Ramifications:

Adding another layer of complexity to the international trade environment is the observed shuffling of air capacity. While the specifics of this reshuffling are not detailed in the update, it suggests a dynamic recalibration of available air cargo space. This could be driven by a variety of factors, including shifts in demand for specific routes, the retirement or introduction of new aircraft, changes in airline operational strategies, or even the ongoing impacts of global events.

When air capacity shifts, it can lead to several consequences:

- Price Volatility: A decrease in available capacity on popular routes can lead to increased air freight rates as demand outstrips supply. Conversely, overcapacity on certain lanes might lead to more competitive pricing.

- Transit Time Fluctuations: Shifts in capacity can also affect transit times, with potential for delays if preferred routes become less available or if airlines reroute flights.

- Carrier Availability: Certain carriers might become more or less dominant on specific trade lanes, impacting the choices available to shippers.

For businesses that rely on air freight for speed and time-sensitive deliveries, understanding these capacity shifts is paramount. Proactive engagement with freight forwarders and carriers, seeking to book space well in advance, and exploring alternative routes or modes of transport where feasible will be crucial to maintaining supply chain resilience and cost-effectiveness.

Looking Ahead:

The Freightos.com update for September 2, 2025, underscores a period of significant regulatory and operational adjustments in the global freight industry. The ongoing challenges to IEEPA tariffs offer a glimmer of hope for potential relief for some, while the closure of the US de minimis threshold presents a clear and immediate challenge for those dealing with smaller import values. The fluid nature of air capacity further necessitates agility and strategic foresight from all participants in the international trade ecosystem.

Businesses are strongly encouraged to stay informed about these evolving trends, consult with their logistics partners, and adapt their strategies to navigate these shifting tides effectively. Understanding and responding to these developments proactively will be key to maintaining competitive advantage and ensuring the smooth flow of goods in the months to come.

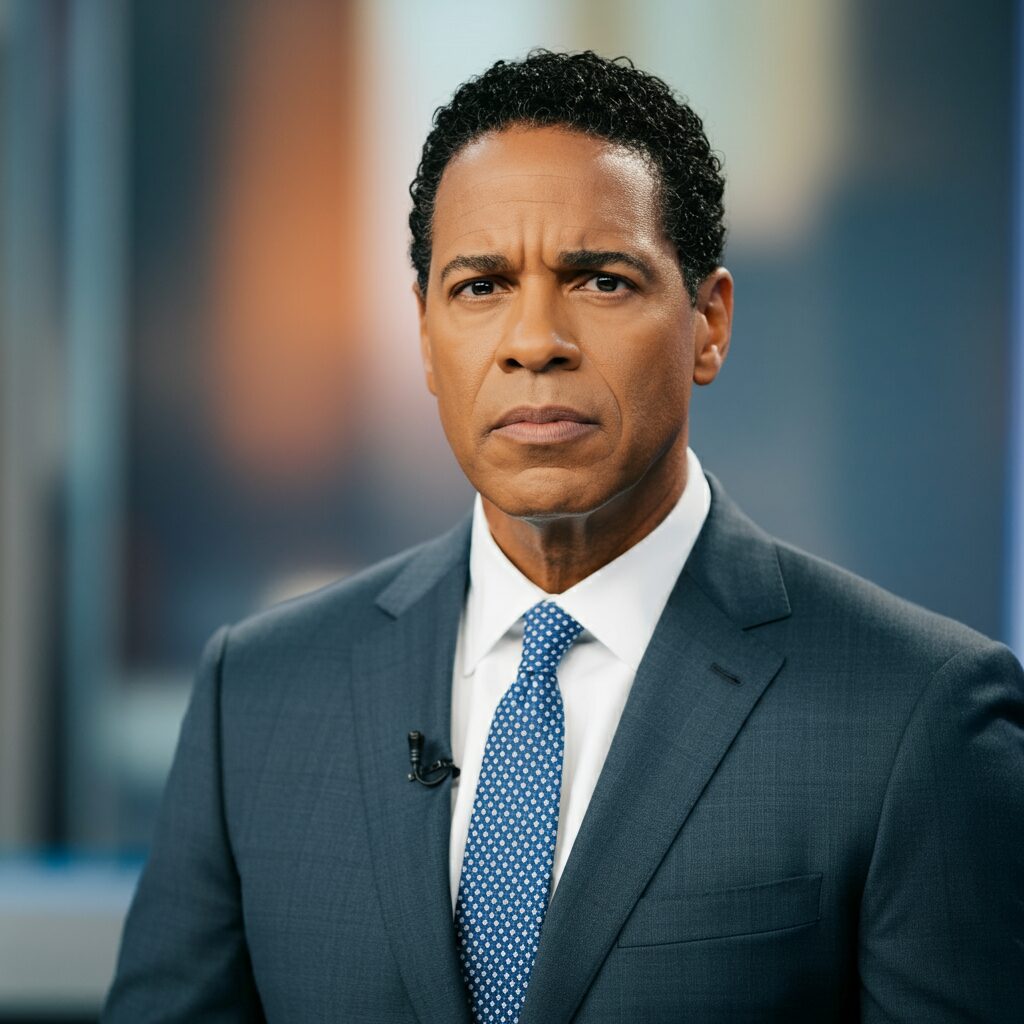

AI has delivered the news.

The answer to the following question is obtained from Google Gemini.

Freightos Blog published ‘Further challenges to IEEPA tariffs; US de minimis closed as air capacity shuffles – September 2, 2025 Update’ at 2025-09-02 17:39. Please write a detailed article about this news in a polite tone with relevant information. Please reply in English with the article only.