Governors’ Council Advocates for Secure and Enhanced Local Tax Revenue

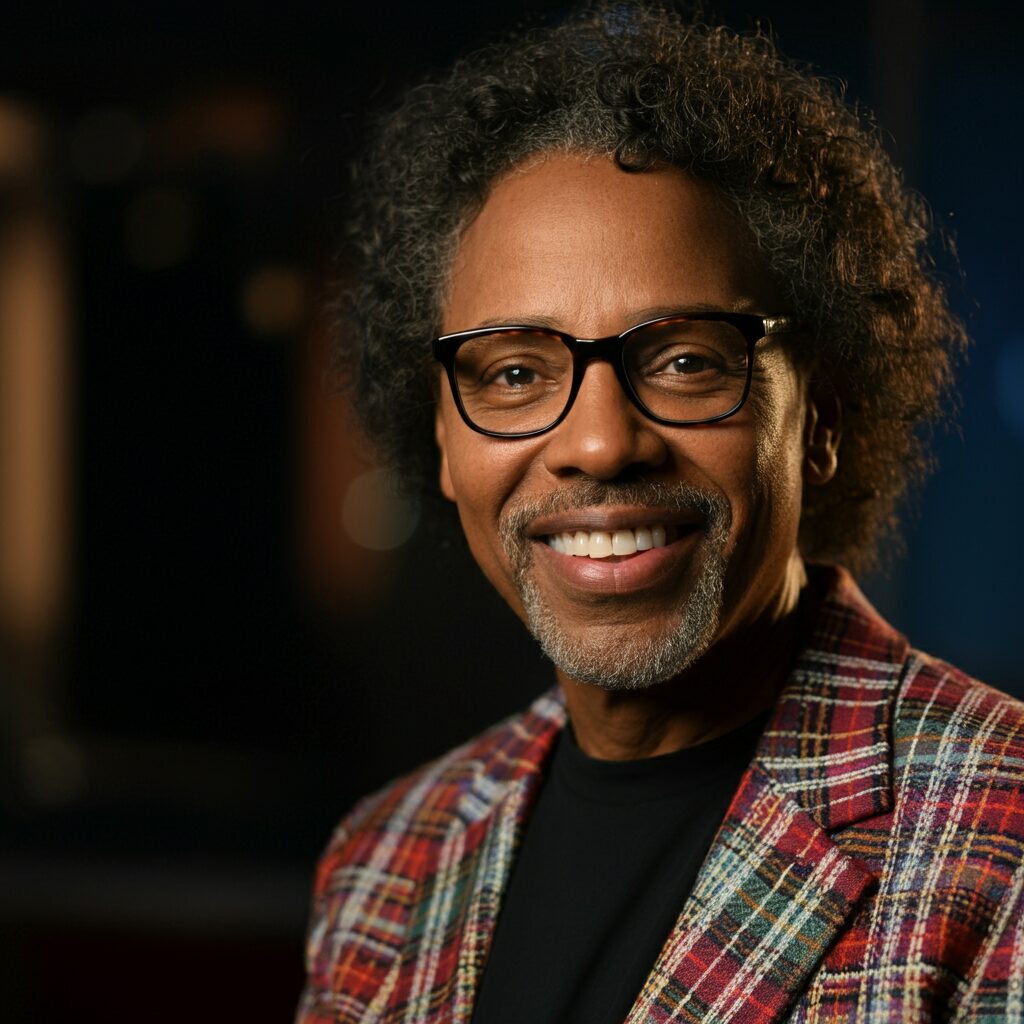

Tokyo, Japan – July 31, 2025 – The National Governors’ Association (NGA) announced today that its Permanent Chairman for Local Tax and Finance, Mr. Kenji Suzuki, has successfully concluded a series of crucial advocacy activities regarding the “Recommendations for Securing and Enhancing Local Tax Revenue.” This proactive initiative underscores the vital importance of a robust and stable financial base for local governments across Japan to effectively serve their communities and address emerging challenges.

The advocacy efforts, which culminated on July 31, 2025, involved Mr. Suzuki engaging with key national stakeholders to present and discuss the NGA’s comprehensive proposals. The recommendations, developed through extensive deliberation by the committee, are designed to address the evolving fiscal landscape and ensure that local governments possess the necessary financial resources to fulfill their responsibilities, including essential public services, infrastructure development, and the implementation of regional revitalization strategies.

The specific details of the “Recommendations for Securing and Enhancing Local Tax Revenue” are extensive and focus on a multi-pronged approach to strengthen the financial autonomy and sustainability of local authorities. While the full content of the recommendations is available on the NGA’s official website, it is understood that the proposals likely address critical areas such as:

- Review and Reform of the Tax System: The recommendations are expected to call for a thorough examination of existing national and local tax structures, with a view to identifying potential adjustments that would create a more equitable and efficient system, ensuring a stable and predictable revenue stream for local governments.

- Allocation and Distribution of National Grants: The NGA is likely advocating for a review of the current system of national grants-in-aid to local governments, aiming for a fairer and more effective distribution that reflects the diverse needs and fiscal capacities of different regions.

- Expansion of Local Tax Sources: A significant focus of the recommendations is anticipated to be on the identification and development of new or enhanced local tax bases, empowering local governments to generate revenue that is more closely aligned with their local economic conditions and service delivery responsibilities.

- Measures to Address Fiscal Challenges: The proposals may also include strategies to mitigate the impact of specific fiscal pressures faced by local governments, such as the aging population, declining birth rates, and regional economic disparities.

Mr. Suzuki’s engagement in these advocacy activities reflects the NGA’s unwavering commitment to fostering strong and responsive local governance. By actively seeking dialogue and presenting concrete proposals, the association aims to build consensus and achieve tangible progress in securing the financial foundations necessary for local governments to effectively address the needs of their citizens and contribute to the overall well-being of the nation.

The NGA expresses its sincere gratitude to all stakeholders who participated in these important discussions and looks forward to continued collaboration to realize a future where local tax resources are both secure and sufficient.

地方税財政常任委員長が「地方税財源の確保・充実等に関する提言」について要請活動を実施しました

AI has delivered the news.

The answer to the following question is obtained from Google Gemini.

全国知事会 published ‘地方税財政常任委員長が「地方税財源の確保・充実等に関する提言」について要請活動を実施しました’ at 2025-07-31 08:30. Please write a detailed article about this news in a polite tone with relevant information. Please reply in English with the article only.