Clear Channel Outdoor Holdings, Inc. Successfully Prices Senior Secured Notes Offerings

New York, NY – July 21, 2025 – Clear Channel Outdoor Holdings, Inc. (NYSE: CCO) announced today the successful pricing of two series of senior secured notes. The company has priced $800 million aggregate principal amount of its 7.750% Senior Secured Notes due 2031 and $800 million aggregate principal amount of its 7.875% Senior Secured Notes due 2033.

This significant financing event marks an important step in Clear Channel Outdoor’s ongoing strategic and financial initiatives. The proceeds from these offerings are earmarked for several key purposes, including refinancing existing indebtedness, general corporate purposes, and potentially funding future growth opportunities.

The pricing of these notes reflects a robust investor appetite for Clear Channel Outdoor’s debt, indicating confidence in the company’s financial stability and future prospects. The issuance is structured to enhance the company’s capital structure and provide greater financial flexibility.

Michael Herrmann, Chief Financial Officer of Clear Channel Outdoor Holdings, Inc., commented on the offering, stating, “We are pleased with the successful completion of these senior secured notes offerings. This transaction strengthens our balance sheet, extends our debt maturities, and provides us with the resources to continue executing our strategic priorities. We are grateful for the strong support from the investment community.”

The offerings are expected to close on or around August 1, 2025, subject to customary closing conditions.

Clear Channel Outdoor Holdings, Inc. is a leading out-of-home advertising company with a significant presence across North America and Europe. The company operates a diverse portfolio of advertising structures, including billboards, street furniture, and transit displays, reaching millions of consumers daily. This latest financing initiative underscores the company’s commitment to optimizing its financial framework and positioning itself for continued success in the dynamic out-of-home advertising market.

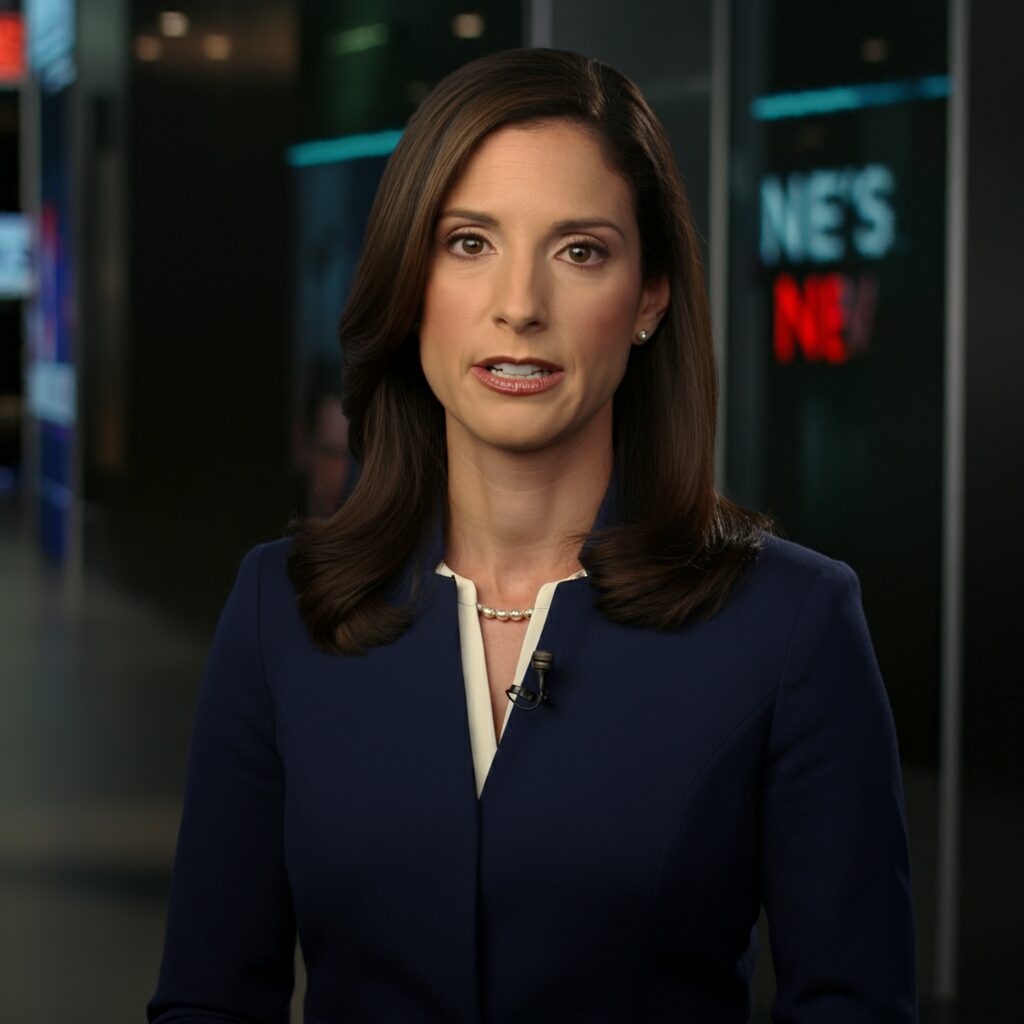

AI has delivered the news.

The answer to the following question is obtained from Google Gemini.

PR Newswire Business Technology published ‘Clear Channel Outdoor Holdings, Inc. Announces Pricing of Senior Secured Notes Due 2031 and Senior Secured Notes Due 2033’ at 2025-07-21 21:30. Please write a detailed article about this news in a polite tone with relevant information. Please reply in English with the article only.