It appears there might be a slight misunderstanding with the date provided. The article you linked from JETRO (Japan External Trade Organization) was published on July 15, 2024, not 2025.

The title of the article is “「大きく美しい1つの法案」、EV税額控除の撤廃など大幅な見直し” which translates to “A ‘Big and Beautiful Single Bill’, Significant Revisions including Abolition of EV Tax Credits”.

Here’s a detailed and easy-to-understand explanation of the article’s content:

Major Overhaul of Tax System Proposed: EV Tax Credits Set for Abolition

Tokyo, Japan – July 15, 2024 – Japan is reportedly considering a significant overhaul of its tax system, with a key proposal involving the abolition of tax credits for Electric Vehicles (EVs). This move is part of a broader legislative effort aiming to create a “big and beautiful single bill” that streamlines and modernizes the tax framework.

The Japanese government and the ruling Liberal Democratic Party (LDP) are reportedly working on a comprehensive tax reform package. While specific details are still being finalized, the elimination of EV tax credits is a prominent feature that has garnered considerable attention.

Why Abolish EV Tax Credits?

The rationale behind this proposed change is multifaceted:

- Maturing EV Market: The article suggests that the EV market in Japan is reaching a point where it can sustain itself without substantial government incentives. As the price of EVs decreases and their availability increases, the need for tax breaks to encourage adoption may be diminishing.

- Fiscal Responsibility: Tax credits represent a significant government expenditure. By phasing them out, the government aims to improve fiscal health and potentially reallocate these funds to other priority areas.

- Broader Tax Reform: The “big and beautiful single bill” concept implies a desire to simplify and rationalize the entire tax system. Removing targeted incentives like EV tax credits could be part of a larger strategy to create a more equitable and efficient tax structure.

- Focus on Other Green Initiatives: While EV tax credits might be removed, the government is likely to continue supporting environmental initiatives through other means. This could include investments in charging infrastructure, research and development of new green technologies, or incentives for other sustainable practices.

What Does This Mean for Consumers and the Auto Industry?

The potential abolition of EV tax credits could have several implications:

- Increased Purchase Price for EVs: Without tax incentives, the upfront cost of purchasing an EV could become higher for consumers, potentially slowing down adoption rates, especially for price-sensitive buyers.

- Impact on EV Sales: The automotive industry, which has been investing heavily in EV production and marketing, might experience a slowdown in EV sales if consumer demand is significantly impacted by the removal of incentives.

- Shift in Government Support: Consumers and manufacturers may need to adapt to a new landscape where government support for EVs is less direct and might focus on other aspects of the EV ecosystem.

- Opportunity for Other Green Vehicles: This change could also create opportunities for other types of environmentally friendly vehicles, such as hybrids or fuel-cell vehicles, if they continue to receive different forms of support.

The “Big and Beautiful Single Bill” Concept

The phrase “大きく美しい1つの法案” (a “big and beautiful single bill”) suggests a desire for a comprehensive and well-structured legislative package. This indicates that the government isn’t just making isolated changes but is aiming for a holistic reform of the tax system. Such a broad approach could encompass various sectors and types of taxes, making it a significant legislative undertaking.

Next Steps and Uncertainty

It’s important to note that this is a proposal, and the final details of the tax reform package are still under discussion. The Japanese government will likely engage in further consultations with industry stakeholders and the public before any concrete decisions are made and implemented.

The JETRO article highlights a significant potential shift in Japan’s approach to promoting EVs and overall tax policy. As the country navigates the transition towards a greener economy, the effectiveness and fairness of its incentive structures will remain a critical point of focus.

This article aims to provide a comprehensive overview based on the JETRO publication. For the most up-to-date and precise information, please refer directly to the original source.

「大きく美しい1つの法案」、EV税額控除の撤廃など大幅な見直し

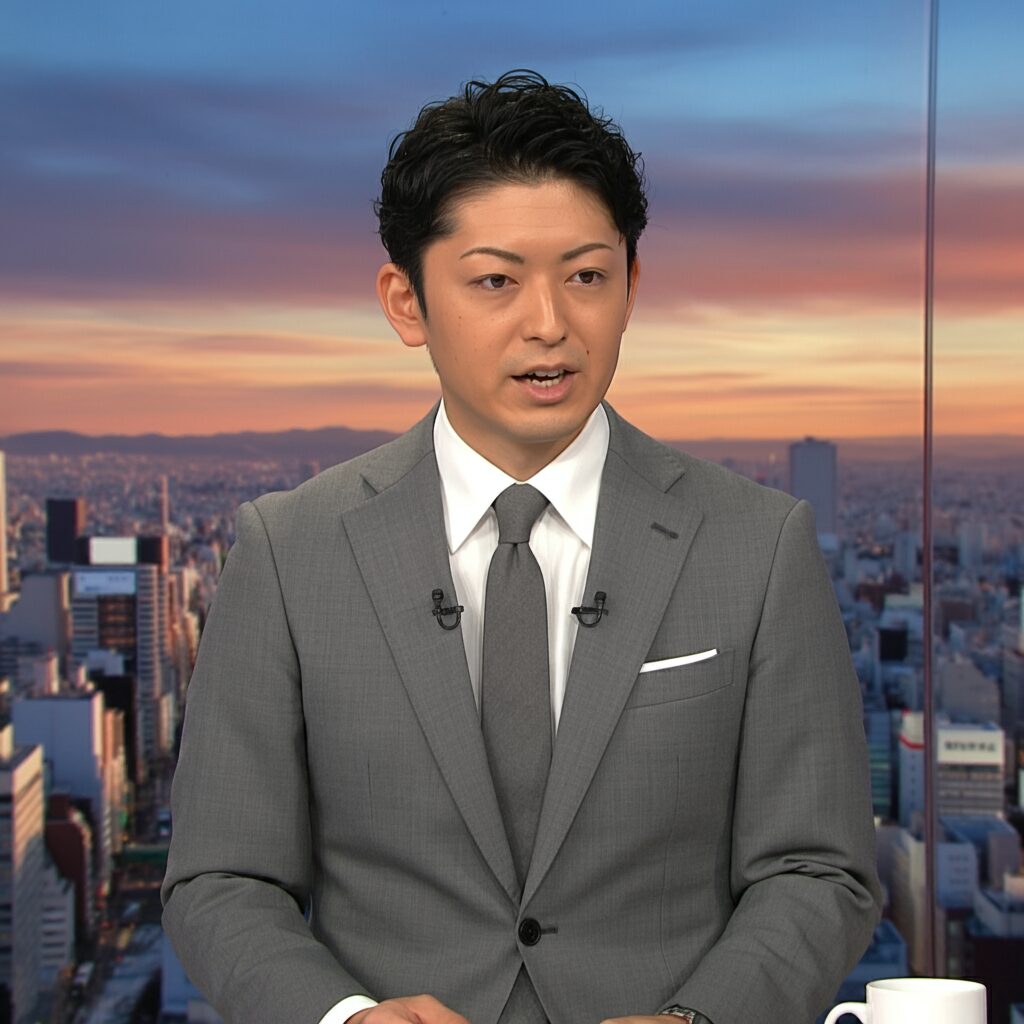

The AI has delivered the news.

The following question was used to generate the response from Google Gemini:

At 2025-07-15 04:40, ‘「大きく美しい1つの法案」、EV税額控除の撤廃など大幅な見直し’ was published according to 日本貿易振興機構. Please write a detailed article with related information in an easy-to-understand manner. Please answer in English.