Federal Reserve Proposes Enhancements to Supervisory Rating Framework for Large Bank Holding Companies

Washington D.C. – July 10, 2025 – The Federal Reserve Board today announced a significant step in its ongoing efforts to strengthen the oversight of large financial institutions. The Board has formally requested public comment on a targeted proposal designed to revise its supervisory rating framework for large bank holding companies, with a particular focus on enhancing the assessment of their “well-managed” status.

This proposed revision reflects the Federal Reserve’s commitment to ensuring the safety and soundness of the U.S. banking system. The “well-managed” component of a supervisory rating is a critical element, as it assesses a firm’s management quality, internal controls, information systems, and risk management processes. These factors are foundational to a bank holding company’s ability to operate safely and soundly, adapt to changing economic conditions, and effectively manage its risks.

The proposal stems from the Federal Reserve’s continuous evaluation of its supervisory practices and its experience in overseeing the largest and most complex financial institutions. By seeking public input, the Board aims to gather diverse perspectives and ensure that its updated framework is robust, practical, and effectively addresses the evolving landscape of financial intermediation.

While the specific details of the proposed revisions are available for review, the core objective is to refine how the Federal Reserve assesses and captures the management and internal aspects of a large bank holding company’s operations. This includes a potential recalibration of how different management attributes are weighted and evaluated within the overall supervisory rating.

The comment period, which opens today, provides an invaluable opportunity for industry participants, consumer advocates, academics, and the general public to contribute their insights. The Federal Reserve encourages all interested parties to submit their feedback, which will be carefully considered as the Board moves forward with this important initiative. The aim is to develop a framework that not only reflects current best practices but also anticipates future challenges and opportunities in the supervision of large financial institutions.

The Federal Reserve believes that a strong and transparent supervisory rating framework is essential for maintaining public confidence in the financial sector. This proposal represents a proactive measure to ensure that the regulatory approach remains effective in safeguarding the U.S. economy. Further information regarding the proposal and instructions on how to submit comments can be found on the Federal Reserve’s official website.

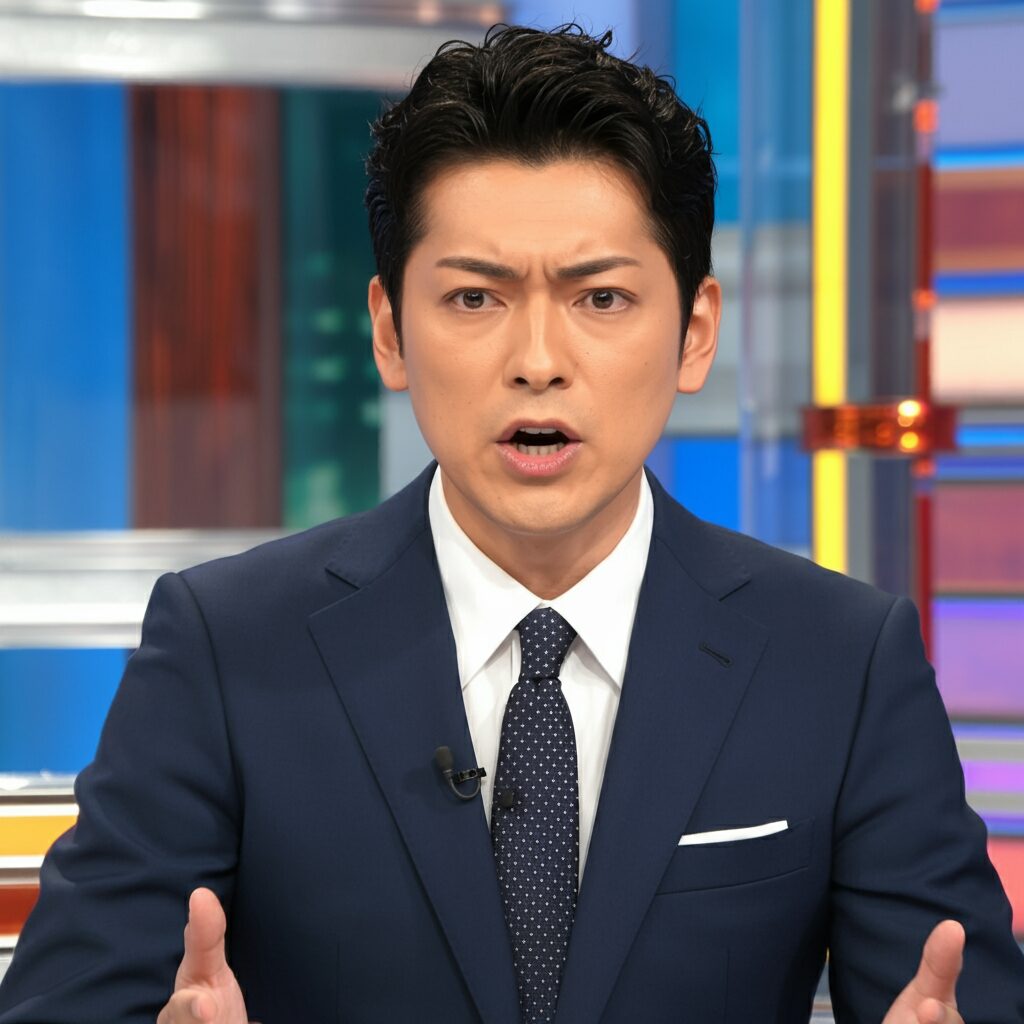

AI has delivered the news.

The answer to the following question is obtained from Google Gemini.

www.federalreserve.gov published ‘Federal Reserve Board requests comment on targeted proposal to revise its supervisory rating framework for large bank holding companies to address the “well managed” status of these firms’ at 2025-07-10 18:15. Please write a detailed article about this news in a polite tone with relevant information. Please reply in English with the article only.