Unveiling the Financial Tapestry: The Federal Reserve’s Latest Insights into the U.S. Economy

The Federal Reserve, a cornerstone of the United States’ economic stability, recently released its updated “Z.1: Financial Accounts of the United States” for the second quarter of 2022. This comprehensive dataset offers a detailed look into the nation’s financial landscape, painting a valuable picture of how households, businesses, financial institutions, and governments interacted and managed their finances during that period.

While the exact date of the publication isn’t specified, the availability of this crucial report marks an important moment for economists, policymakers, and anyone interested in understanding the intricate workings of the U.S. economy. The Z.1 report, also known as the Flow of Funds Accounts, is a vital tool that helps us track the flow of funds through different sectors, understand asset and liability movements, and gain insights into broader economic trends.

What does this new data tell us?

The release of the Q2 2022 Z.1 data allows us to examine a snapshot of the financial health and activities of the U.S. economy during a period of evolving economic conditions. We can delve into:

- Household Finances: The report provides insights into how American households managed their wealth. This includes details on their assets (like stocks, bonds, and real estate) and liabilities (such as mortgages, credit card debt, and student loans). Understanding these trends can shed light on consumer confidence, spending patterns, and overall financial well-being.

- Business Sector Activities: For businesses, the Z.1 data offers a look at their borrowing, lending, and investment activities. This can reveal trends in corporate finance, capital expenditures, and the overall health of the business environment. Are companies investing more, taking on more debt, or generating higher profits? The Z.1 can help answer these questions.

- Financial Institutions’ Roles: The report meticulously tracks the balance sheets of various financial intermediaries, including banks, credit unions, and investment funds. This helps us understand their role in facilitating economic activity, their exposure to different risks, and their contribution to the overall financial system’s stability.

- Government Finance: The Z.1 data also captures the financial activities of federal, state, and local governments, including their borrowing and debt levels. This provides a clearer picture of fiscal policy and its impact on the broader economy.

Why is this information so valuable?

The Federal Reserve’s Z.1 report is more than just a collection of numbers; it’s a vital resource for:

- Economic Analysis: Economists use this data to conduct in-depth analysis of economic trends, identify potential risks, and forecast future economic performance. It’s a foundational dataset for understanding the transmission mechanisms of monetary policy.

- Policy Making: Policymakers at the Federal Reserve and in other government agencies rely on the Z.1 data to inform their decisions. It helps them assess the effectiveness of current policies and develop strategies to promote economic growth and financial stability.

- Market Participants: Investors, financial advisors, and businesses use this information to make informed decisions about investments, lending, and strategic planning. Understanding the financial flows can provide a competitive edge.

- Academic Research: Researchers in economics, finance, and other related fields utilize the Z.1 data for a wide range of studies, contributing to our collective understanding of economic behavior.

A Glimpse into the Future (and the Past):

By studying the changes and trends within the Z.1 data from quarter to quarter, we can observe how the U.S. economy evolves. The Q2 2022 report, in particular, allows us to understand the financial dynamics at play during a period that likely saw ongoing adjustments to inflation, interest rates, and global economic developments.

The Federal Reserve’s commitment to providing transparent and comprehensive data, such as the Z.1 Financial Accounts of the United States, is instrumental in fostering a well-informed public and a more resilient economy. We encourage those with an interest in the economic well-being of the nation to explore this detailed dataset and gain a deeper appreciation for the complex and interconnected nature of our financial system.

Z1: 2022:Q2 data now available for the Financial Accounts of the United States

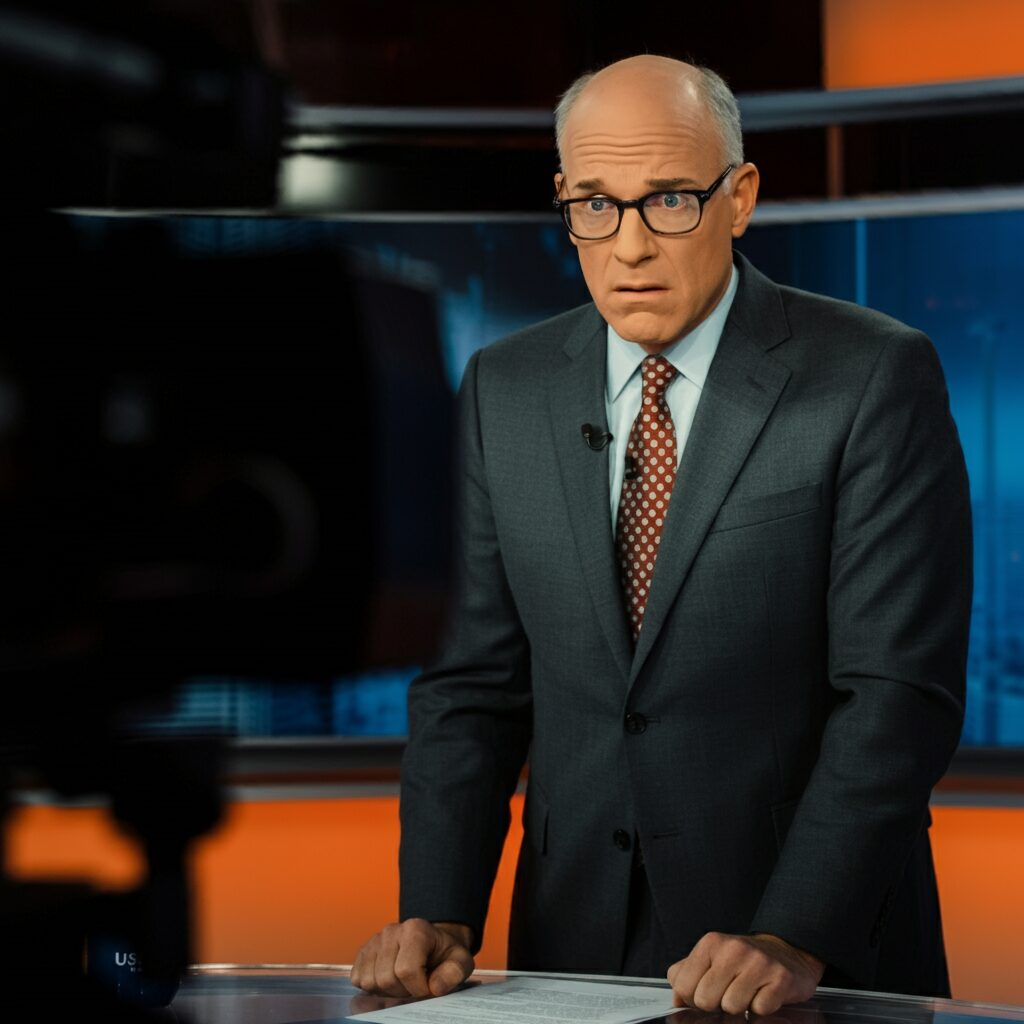

AI has delivered the news.

The answer to the following question is obtained from Google Gemini.

www.federalreserve.gov published ‘Z1: 2022:Q2 data now available for the Financial Accounts of the United States’ at date unknown. Please write a detailed article about this news, including related information, in a gentle tone. Please answer only in English.