Waller: What Roles Should the Private Sector and the Federal Reserve Play in Payments?

November 12, 2024

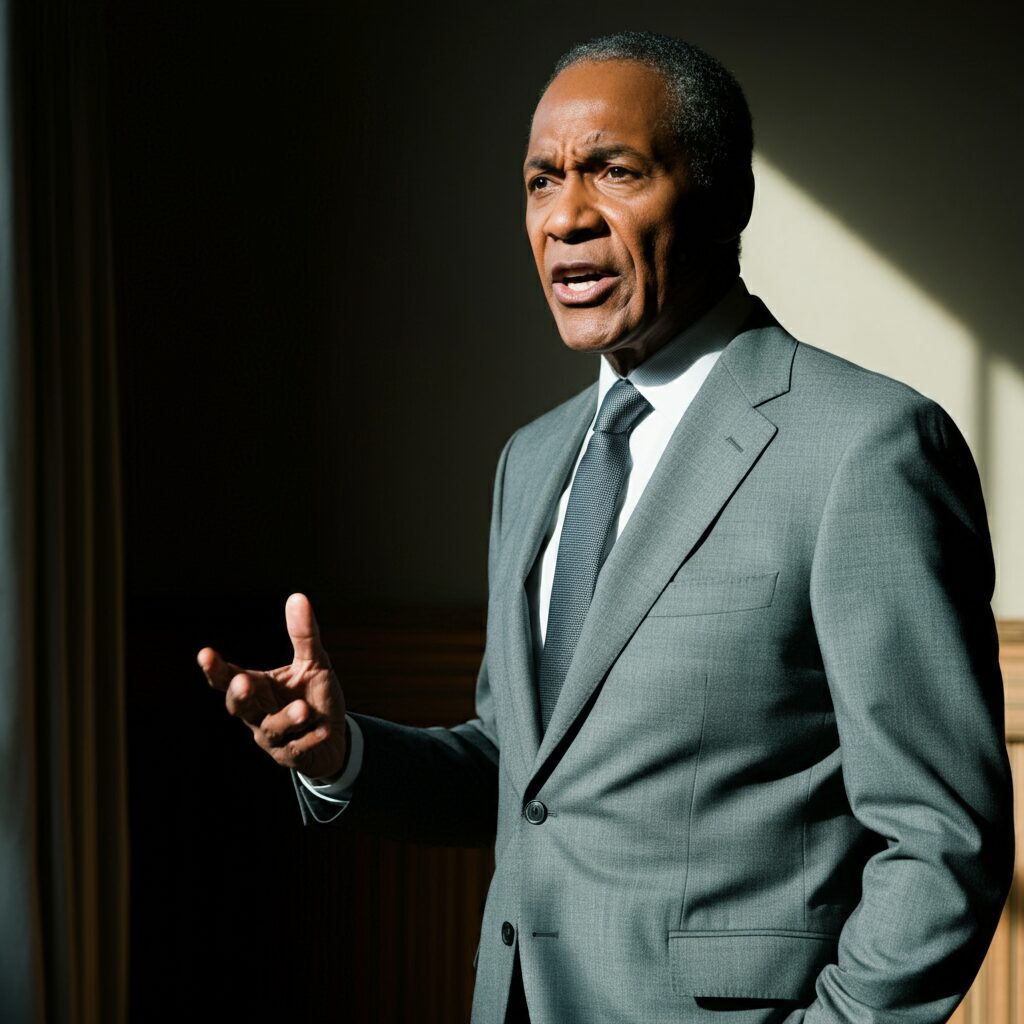

Federal Reserve Governor Christopher Waller delivered a speech today at the Brookings Institution in Washington, D.C., on the future of payments. In his remarks, Waller discussed the roles that the private sector and the Federal Reserve should play in ensuring that the U.S. payments system remains safe, efficient, and accessible.

Waller began by noting that the payments landscape is rapidly evolving. The rise of new technologies, such as mobile payments and digital currencies, is giving consumers and businesses more options for sending and receiving money. At the same time, the increasing interconnectedness of the global economy is making it more important for the U.S. payments system to be able to operate seamlessly with other countries’ systems.

Waller argued that the private sector is best positioned to lead the way in developing new and innovative payments technologies. The private sector has the flexibility and agility to respond to the changing needs of consumers and businesses. It also has the incentive to invest in new technologies that can improve the efficiency and security of the payments system.

However, Waller also said that the Federal Reserve has an important role to play in the payments system. The Fed is responsible for ensuring that the payments system is safe, sound, and efficient. It also has a role to play in promoting access to the payments system for all Americans.

Waller outlined several specific areas where he believes the Federal Reserve can play a constructive role in the payments system. These areas include:

- Promoting competition and innovation. The Fed can help to promote competition and innovation in the payments system by encouraging the entry of new players and by reducing barriers to entry.

- Ensuring the safety and soundness of the payments system. The Fed can help to ensure the safety and soundness of the payments system by overseeing the clearing and settlement of payments and by regulating payment service providers.

- Promoting access to the payments system. The Fed can help to promote access to the payments system for all Americans by working to reduce the cost of payments and by expanding the availability of payment services in underserved communities.

Waller concluded his remarks by saying that the future of payments is bright. The private sector is developing new and innovative technologies that are making it easier, faster, and more secure to send and receive money. The Federal Reserve is committed to working with the private sector to ensure that the U.S. payments system remains safe, efficient, and accessible for all Americans.

Waller, What Roles Should the Private Sector and the Federal Reserve Play in Payments?

The AI has provided us with the news.

I’ve asked Google Gemini the following question, and here’s its response.

FRB a new article on 2024-11-12 15:00 titled “Waller, What Roles Should the Private Sector and the Federal Reserve Play in Payments?”. Please write a detailed article on this news item, including any relevant information. Answers should be in English.

40