New Legislation Aims to Streamline and Enhance Disaster Loan Programs

Washington D.C. – A significant piece of legislation, H.R. 4238 (IH), titled the “Disaster Loan Accountability and Reform Act,” was officially published on July 15, 2025, at 04:03. This new bill, introduced in the House of Representatives, signals a proactive effort to address and improve the effectiveness and transparency of federal disaster loan programs.

The Disaster Loan Accountability and Reform Act is designed to bring about substantial changes to how the nation manages and administers financial assistance to individuals and businesses affected by natural disasters. While the specific details of the act will become clearer as it progresses through the legislative process, the title itself suggests a dual focus on ensuring greater accountability from administering bodies and implementing reforms to make the loan application and disbursement process more efficient and responsive to the needs of disaster survivors.

The need for such legislation is often highlighted in the aftermath of major catastrophic events. Survivors frequently face complex application procedures, lengthy waiting times for crucial financial aid, and challenges in understanding the terms and conditions of the loans. This act appears to be a direct response to these concerns, aiming to build a more robust and user-friendly system for disaster recovery.

Key areas likely to be addressed by the Disaster Loan Accountability and Reform Act could include:

- Improved Transparency: The bill may introduce measures to make information regarding loan eligibility, application status, and fund disbursement more accessible to the public and disaster victims. This could involve enhanced online portals, clearer communication channels, and standardized reporting.

- Streamlined Application Processes: A core objective is likely to be simplifying the application process for disaster loans. This could involve reducing bureaucratic hurdles, leveraging technology to expedite reviews, and providing more comprehensive assistance to applicants.

- Enhanced Oversight and Accountability: The “Accountability” aspect of the title suggests a focus on strengthening oversight mechanisms for the agencies responsible for administering these loans. This could translate to clearer performance metrics, regular audits, and measures to prevent misuse of funds.

- Program Modernization: Reforms might also encompass updating the underlying technology and operational frameworks of disaster loan programs to ensure they are equipped to handle the scale and complexity of modern disaster recovery efforts.

- Better Support for Survivors: The act could also introduce provisions aimed at providing more tailored support to different categories of disaster survivors, such as small businesses, homeowners, and non-profit organizations, ensuring that aid is distributed equitably and effectively.

The introduction and publication of H.R. 4238 (IH) represent a crucial step in the legislative journey. As the bill moves forward, it will undergo scrutiny and potential amendments from lawmakers in both the House and the Senate. Community leaders, disaster relief organizations, and affected individuals will undoubtedly be watching its progress closely, hoping it will usher in a new era of efficient, accountable, and compassionate disaster assistance. This initiative underscores a commitment to ensuring that federal aid is a reliable lifeline for those facing the immense challenges of rebuilding their lives and communities after a disaster.

H.R. 4238 (IH) – Disaster Loan Accountability and Reform Act

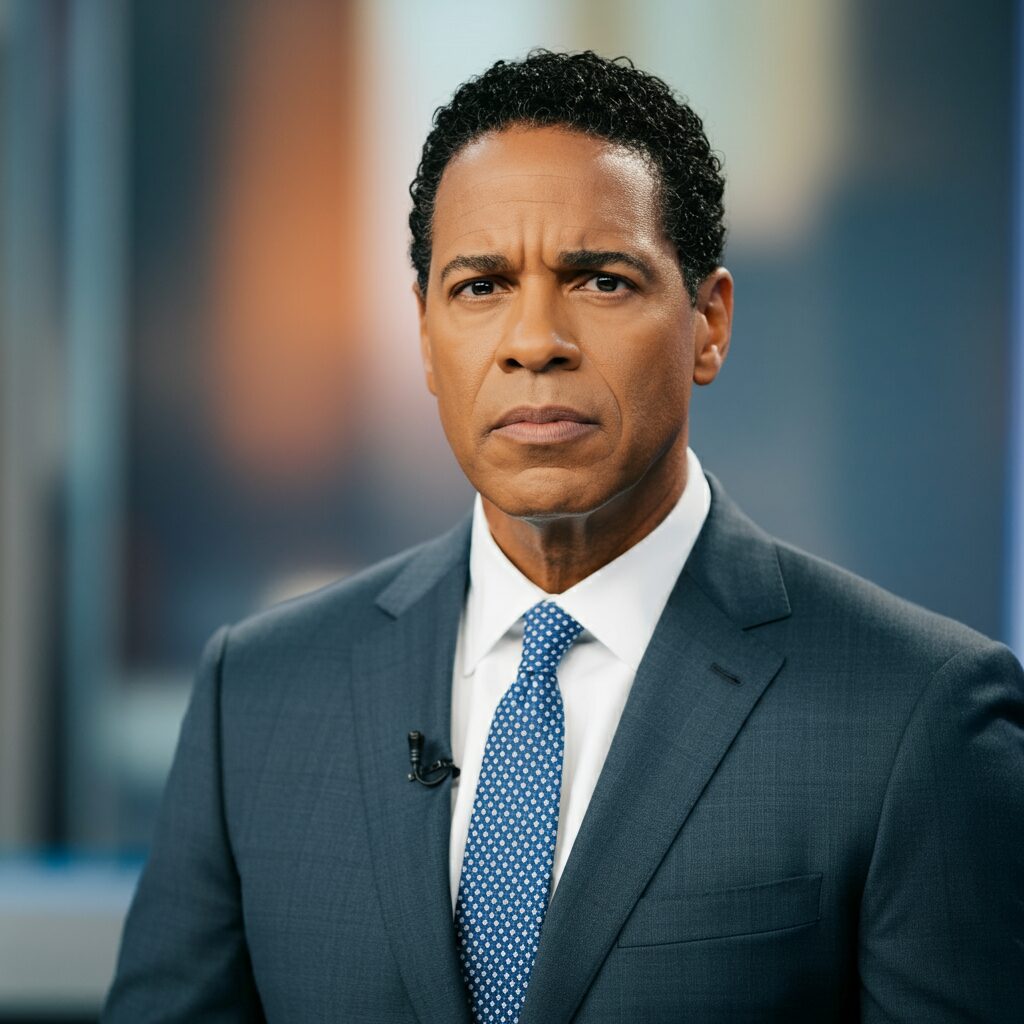

AI has delivered the news.

The answer to the following question is obtained from Google Gemini.

www.govinfo.gov published ‘H.R. 4238 (IH) – Disaster Loan Accou ntability and Reform Act’ at 2025-07-15 04:03. Please write a detailed article about this news in a polite tone with relevant information. Please reply in English with the article only.