Japan Exchange Group Updates Margin Trading Statistics: Key Insights into Market Sentiment

Tokyo, Japan – July 24, 2025 – Japan Exchange Group (JPX) has today released its latest statistics on margin trading balances, providing valuable insights into current market sentiment and investor activity. The update, published on their official website, reflects the outstanding balances for margin trading as of the latest reporting period.

Margin trading, a practice that allows investors to leverage their capital by borrowing funds from securities firms to trade securities, serves as a significant indicator of market sentiment and investor confidence. The data released by JPX offers a comprehensive overview of the extent to which investors are utilizing leverage in the Japanese equity markets.

While specific figures from the newly released data are subject to individual analysis by market participants, the regular publication of these statistics by JPX underscores the group’s commitment to transparency and providing essential information to facilitate informed investment decisions.

Key aspects typically analyzed from JPX’s margin trading data include:

- Overall Margin Balance: The total amount of outstanding loans for margin trading can indicate the general level of leverage being employed by investors. A rising balance may suggest increased bullish sentiment, while a declining balance could signal caution or a shift towards risk aversion.

- Margin Trading on Margin (Buying on Margin) vs. Margin Trading for Short Selling (Selling Short): The breakdown between these two components offers further granularity. High levels of “buying on margin” often point to strong bullish conviction among investors who are expecting stock prices to rise. Conversely, increased “selling short” might indicate bearish sentiment, with investors anticipating price declines.

- Sectoral or Individual Stock Trends: While the published data is typically aggregated, sophisticated analysis can often infer trends within specific sectors or even individual heavily traded stocks based on their contribution to the overall margin balances.

- Comparison with Historical Data: Understanding current margin balances in the context of historical trends provides a deeper appreciation of market dynamics and potential turning points.

The update released today, “マーケット情報]信用取引残高等-信用取引現在高を更新しました” (Market Information: Margin Trading Balances, etc. – Margin Trading Outstanding Balance Updated), is a crucial resource for investors, analysts, and financial institutions seeking to gauge the pulse of the Japanese stock market.

JPX plays a vital role in the efficient functioning of the Japanese financial markets, and the timely release of such data is instrumental in fostering a well-informed and stable investment environment. Investors are encouraged to review the updated statistics on the JPX website for their own detailed analysis and to inform their trading strategies.

[マーケット情報]信用取引残高等-信用取引現在高を更新しました

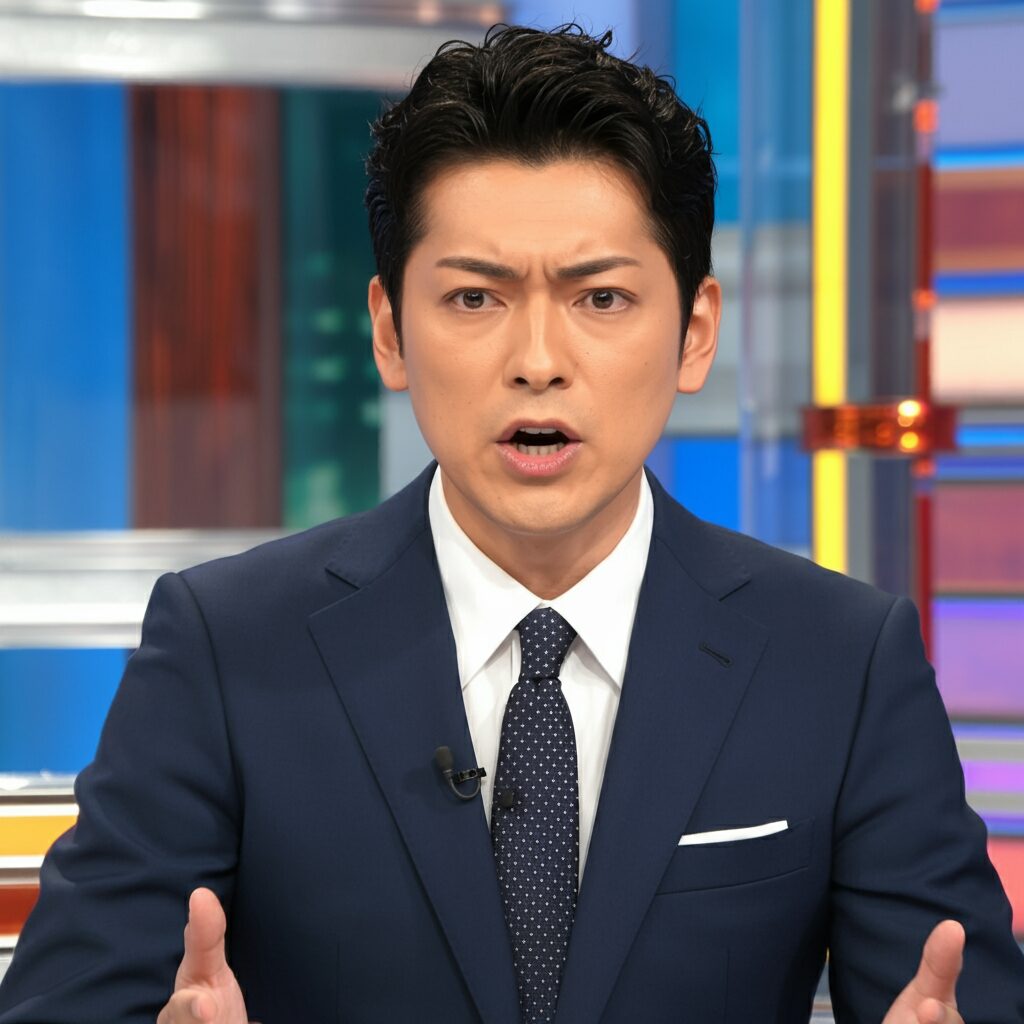

AI has delivered the news.

The answer to the following question is obtained from Google Gemini.

日本取引所グループ published ‘[マーケット情報]信用取引残高等-信用取引現在高を更新しました’ at 2025-07-24 06:00. Please write a detailed article about this news in a polite tone with relevant information. Please reply in English with the article only.